Online Trends & Statistics for UK, Europe & N. America 2022-2024

Our figures for online retailing in the UK and Western Europe have been updated and now include final totals for 2023-4. The rankings and growth rates have been dramatically altered by the boost in online sales caused by the coronavirus pandemic.

These are the first estimates of online sales and the online sales share for a range of European countries as well as the U.S.. They have the advantage of being calculated on a consistent basis using a consistent definition of 'retail'.

The figures relate only to retail sales. They exclude services such as hospitality/restaurants, tickets, vacations, travel and vehicle fuel. They may well differ from estimates based on a wider definition of ecommerce. By 'retail sales' we mean the sale of goods to the final consumer. U.S. totals have been adjusted to bring them into line with our definition of retail sales – ie. excluding vehicle fuel, auto sales and prepared food sales (hospitality).

European Online Growth

In most sectors of the retail economy, e-commerce has become the fastest growing segment of the retail market. Pure-play e-commerce retailers have been joined by online marketplaces as well as the online presence of bricks-and-mortar retailers that previously operated almost exclusively from shops. UK retailers such as Next and John Lewis & Partners now derive only a minority of their sales from their retail premises.

Combined ecommerce sales in Western Europe (UK, Germany, France, Netherlands, Italy and Spain) were £152.20bn in 2015. By 2022 they had reached £328.91bn (+116.1% growth)

The pandemic (2020-2021) The most-recent two years (2020-2021) have affected the ecommerce ranking of many countries as shoppers, faced with the pandemic, bought considerably more goods online than they had ever done. Many smaller retailers took the opportunity of lockdown to develop their own websites and delivered merchandise to customers or used third-parties to make deliveries. Non-food businesses were adversely affected by lockdowns. Even when they were permitted to be open for business, the reduced footfall in towns and cities meant it was often unprofitable to continue in the same way as before. Companies affected directly by lockdown, particularly furniture, household, department stores, sports and clothing, improved their web offerings in response to customers moving from buying from shops to buying online.

Widespread Learning about Online retailing. Curbs on travel and concerns about the possible dangers of using public transport meant that the numbers of shoppers fell considerably in major shopping destinations. This also meant that purchases from department stores and luxury retailers were increasingly made online. Online sales in the UK, Germany, France, Netherlands, Italy and Spain rose by an average of 31.1% in 2020. Shoppers who had never bothered much about online stores had to learn how to buy goods online and shared their experience with others. This included older people whose knowledge of IT may well have been weak and their computer equipment rather slow and unsuitable. Nevertheless, they managed and online businesses worked hard to ensure that important requirements such as prescriptions and medical products were prioritised as well as online deliveries of food and groceries to the elderly. During the pandemic, delivery slots were at a premium as more and more people wanted online groceries and tried to book slots. The UK government told online grocers that they must make delivery slots available for the elderly. The UK saw online food sales double during the pandemic.

Shopper Numbers. A result of the pandemic was widespread forced learning about how to use online retailing and a rapid growth in online sales, particularly when shops were locked down in order to reduce the spread of coronavirus. When shops were reopened footfall was slow to recover. Indeed in many towns and cities shopper numbers even in 2023 are likely to be, at best, 10%-15% lower than before the pandemic. However, in the UK - irrespective of footfall - when shops were reopened there was a considerable jump in sales (the final section of our RETAIL FORECAST webpage gives more info about spending trends in the pandemic).

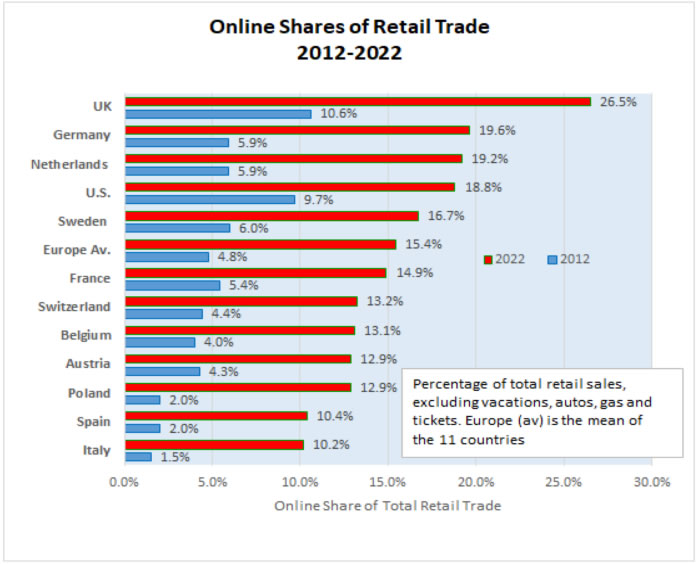

Growth in Online Market Share. Covid and the lockdowns boosted online market shares in every Western country. Figure 1 shows the remarkable rise in the online share of the retail sector between 2012 and the end of 2022. At the beginning of the 2010s, Spain and Italy had only a very basic online retail sector, but by 2022 online was responsible for 10%-plus of the sales of their retail industries.

In the UK, online market share shot up from 10.6% (2012) to 26.5% (2022). Indeed in November 2020-April 2021 and November 2021-January 2022 the online market share (of a diminished retail sector) was more than 30%, even reaching more than 35% for a brief period. However as we predicted at the time:

- the online market share would fall when shops reopened; online sales fell by 12% in 2022, new share 26.3%

- online market shares would not revert to pre-pandemic levels now that so many people had become used to the benefits of online retailing.

Figure 1

On average ,therefore, online retailing in Europe has seen its market share rising from 4.8% in 2012 to 15.4% today. No Western country has stood apart from this major change in the way retailing is now conducted.

Online Growth in North America: market share now 18.8%

The onset of coronavirus had a similar, if less intense, effect in the U.S. as in Europe. Online spending rose, but as each state had different regulations relating to shops and what shoppers were allowed to do, the boost was not as strong as in Europe. The U.S. online retailing market share (using a consistent definition of retail) rose from 9.7% in 2012 to 18.8% today.

The U.S. is the headquarters of many ecommerce supergroups and market places with a global reach. It has the largest ecommerce retail sector of any country. One problem with U.S. estimates is that the Census Office there includes prepared food, petrol and diesel sales and the sale and repair of vehicles in the retailing bin. This understates online retail, because in Europe, retail is simply the sale to the final consumer of retail products and categories such as vehicle fuel, car sales etc are not as susceptible to e-commerce as retail products. The data in Figure 1 excludes these non-retail (from our viewpoint) categories, increasing market share from around 14.8% to 18.8%.

One would have thought that the U.S. market share would be the highest of any country: probably that would be true of the East and the West coast. However it is a very big country. Shipping merchandise from one region to another will be expensive. The distance between New York and San Francisco is 2,565.68 miles (4,129.06 km), which is roughly the same distance as a trip to Kazan in Tatarstan, Central Russia (2,323 miles or 3,739km), somewhere so far away that hardly anyone has been there.

Table 1 (below) gives recent ecommerce totals and market shares for six major Western European countries. The results are dominated by total online sales in the UK, Germany and France. These three made up 77.8% of major Western European ecommerce in 2022 (£256m). Britain had the largest online retail sector. German ecommerce grew from a share in 2019 of 14.2% to 19.6% in 2022, and France's from 9.7% to 14.9% over the same period. Special mention should be made of The Netherlands, whose online market share rose from 15.3% in 2019 to 19.2%. A large proportion of Dutch online retailing and e-shopping involves cross-border sales so the figures may be less accurate than for the other countries.

Table 1

Total Online Retail Sales 2019-2022

Currency values are Sterling (£) billions

|

2019 |

2022 |

Share of Online Sales 2019 |

Share of Online Sales 2021 |

||

| UK | £75.478 | £106.010 | 19.2% | 26.5% | |

| France | £41.607 | £59.697 | 9.7% | 14.9% | |

| Germany | £61.031 | £90.337 | 14.2% | 19.6% | |

| Spain | £20.353 | £27.782 | 7.8% | 10.4% | |

| Italy | £16.318 | £24.911 | 5.9% | 10.2% | |

| Netherlands | £13.872 | £22.400 | 15.3% | 19.2% | |

| Totals | £228.660 | £328.909 | 12.0% | 16.8% |

[source: estimates by CRR]

Cross-border trade

Shoppers in countries with a small online sector may well buy more goods from neighbouring countries simply because the options are more limited at home. This was true for many years of Italy. There are legal issues of course when buying online goods from another country, if you want to return them for credit or raise a dispute because they are unsatisfactory. These problems can be overcome to some extent when using a marketplace such as Amazon or eBay or an eWallet such as Paypal. Around one-third of online shoppers say they have bought something from a foreign country. Although many countries have now introduced legislation to cover customer rights when buying online, this is only worthwhile for a cross-border shopper if the goods are of high value. Online retailers naturally benefit from cross-border customers, who may be of higher net worth, perhaps looking for goods that are not readily available at home or which are cheaper in other countries. Building a reputation for efficient fulfilment in other countries may also play a part in helping an online retailer to decide whether to enter a particular country’s market. It can sometimes be difficult to know how cross-border the retailer actually is. For what Amazon regards as legitimate tax reasons, invoices tend to come marked as Lichtenstein or Dublin irrespective of where the computers are located or where goods are shipped from.

Paying for Online Goods. Seemingly similar countries with common financial institutions may still be very unlike one another regarding how shoppers pay for online goods. The major theme is: ‘difference’.

- While there are many similarities, each country is different in the way shoppers pay for retail goods ordered online.

- There may be local payment brands that people like to use and have got used to their use.

- There can be a number of smaller methods of payment in different countries that have become custom-and-practice for some purposes. These include: payment by invoice, invoice after delivery, cash on delivery (COD) and bank transfer. Significantly, many of these mean that payment is made when delivery occurs or even after delivery.

Credit cards, debit cards, eWallets are used in many countries but are not predominant everywhere.

Since the 2008 recession, debit cards have taken over (from credit cards) as the UK’s main method of making online payment, followed by credit cards and then eWallets such as Paypal. Much used across the EU is a set of banking protocols called SEPA. SEPA stands for Single European Payments Area and allows shoppers to send and receive euro payments between two cross-border banks with no hassle.

In Italy only 45% of the population has a credit card, Credit cards and eWallets each comprise more than one-third of online payments, but local eWallet providers are used such as Satispay and Bancomatpay.

Portugal has a system of e-cheques, where you make your payment in a supermarket or petrol filling station against an invoice. Other methods include debit cards and eWallets (mostly using Multibanco).

In Spain eWallets comprise more than one-half of all payments for online retailing, followed by credit and debit cards, with cash on delivery and late invoice having smaller shares.

In The Netherlands, the key payment role is held by iDeal (95% of all payments), which is run by a consortium of all the main banks. This is a mobile banking app, which provides SEPA credit transfers from their accounts. Shoppers also use credit cards, PayPal, AfterPay and Klarna.

The Swiss pay by credit card, invoice and eWallet.

French e-commerce shoppers use credit cards, eWallets and bank transfers.

In Poland, the most popular system is Blik, which is a bank mobile payment app. Also important are bank transfers and credit cards.

Slightly more than one-half of all Norwegian online purchases are made using credit cards. More than one-fifth use VIPPS, a mobile payment app.

In Sweden, the most frequent method is payment against invoice, followed by credit card, and then payment using Swish, a mobile app run by six local banks, Bankgirot and Sweden’s Central bank.

In Germany, eWallets hold more than 40% of the payment market, followed by pay against invoice, credit card, bank transfer, direct debit and SEPA mobile phone app. COD and payment after delivery are also used.

In Spain, eWallets hold half the payments market, and the remainder is debit and credit cards, COD and invoice after delivery.

In Belgium, the most significant is Bancontact, a bank card that is a payment card or can be used with a mobile app.

Lastly in Denmark, the most common payment method is a Dancort, a national debit card (that acts as a credit card outside Denmark) and mobile app owned by Danske Bank. Credit cards are used for more than one-third of transactions, followed by other mobile apps. ,

Online Spending on Mobiles: now more than 50% of the total

Online purchasing using smartphones has expanded dramatically in the past six years and now accounts for more than half of all European ecommerce. This is a function both of how significant smartphones have become to our daily lives and the success of retailers in making their websites easy to use and to make payments. In countries like the UK and Germany 80% of product searches are done using smartphones. People may be checking out offers or placing orders, lying in bed at 6 am, travelling on a bus at 8.30am, waiting at a railway station at 6pm or talking over possible acquisitions with their friends at any time of day or night. Although working from home (WFH) in the pandemic might seem likely to change these habits, to be able to search retailers’ websites and place orders in any room of the house or outside it has proved increasingly irresistible.

Mobile commerce is discussed further in our webpage Mobile Retailing

The Research

The Centre for Retail Research has forecast the trends in online retail sales in Europe and the U.S. for more than ten years. Over recent years, we have carried out consumer surveys of 5,500 shoppers in each country plus interviews with retail businesses that account for more than 20% of retail sales.

Main Results: Regular and Unceasing Growth (so far)

The 2008 recession induced many shoppers to switch to cheaper retailers, and this often involved buying online rather from traditional stores. The fact that internet search is now comparatively easy and predictable has made online retailing attractive when buying a wide range of products. The widespread use of debit and credit cards in the UK and France (plus mobile payment apps and bank payment systems in many other countries) combined with strong legal protection for buyers has supported the increased use of online retailing.

Recent trends include:

- the coronavirus pandemic and the associated lockdowns have accelerated the rate of growth of online retail, particularly in grocery/food e-commerce, fashion, housewares and furniture;

- the rapid takeup of mobile ecommerce: by 2020 mobile accounted for more than 50% of UK online sales, 48% of German online sales and 45% of online sales in The Netherlands;

- the growth of the ecommerce arms of traditional bricks-and-mortar retailers that do price-comparisons against Amazon or other online traders and gradually move towards multi-channel operations, selling online benefits instore and instore benefits online;

- the expansion of ‘click and collect’ as an alternative to home delivery;

- the growing use of small-scale delivery options (bicycles, mopeds/motorscooters, cars) similar to those used for restaurant/takeaway delivery services to meet 30 minute-one hour fast-home online delivery requirements could become very important in city residential areas and prosperous towns. We acknowledge that in the post-covid period many of these services have been cut back, but will become increasingly important in the longer term.

Proportion of Population that Shops Online

Even by 2019 only an average of 61.1% of the population of Western Europe shopped online at least once in 12 months. However this figure is skewed by the low figures of some countries. The numbers of eShoppers as a percentage of the population in the UK, Germany, The Netherlands and France all exceed 70.0% and the current rapid growth of ecommerce in Spain and Italy should mean that soon these countries should hit the 70% figure in three or four years’ time.

Table 2

Number of eShoppers as Percentage of Population (Updated)

| 2019 | 2020 | |

| United Kingdom | 75.8% | 76.9% |

| France | 68.5% | 72.4% |

| Germany | 70.2% | 76.4% |

| Spain | 42.1% | 51.2% |

| Italy | 37.7% | 49.6% |

| The Netherlands | 72.2% | 76.1% |

| Averages | 61.1% | 67.1% |

[source: Centre for Retail Research]